CARB Proposes Amendments to LCFS: How Changes Will Affect Fleet Owners

July 14, 2024

The California Air Resources Board (CARB) recently proposed several key changes to the Low Carbon Fuel Standard (LCFS) in an impact assessment report. The proposed amendments would increase the stringency of the LCFS and accelerate California’s push to carbon neutrality.

This article provides an overview of the proposed amendments to the LCFS and explains how these changes would affect fleet owners and owners of electric forklifts.

Proposed Changes to the Low Carbon Fuel Standard

In September 2023, CARB released a standardized regulatory impact assessment (SRIA) to analyze the effects of newly proposed amendments to the Low Carbon Fuel Standard. The key changes, which could go into effect as early as 2025, include:

- Lowering credit generation potential for low-carbon forklifts: Phasing out credit generation for low-carbon forklifts. While a ruling hasn’t been made yet, it’s likely that only fully electric small forklifts will be eligible to generate LCFS credits in the future.

- More aggressive carbon intensity (CI) targets: Accelerating the reduction of CI benchmarks through 2030 and extending these targets to 2045. This change aims to phase out high-carbon fuels (fuels with a high CI) faster.

- Implementing an automatic acceleration mechanism: Automatically decreasing the allowable CI score of fuels to account for the overproduction of LCFS credits, keeping credit values consistently high.

- Investing in electric vehicle charging infrastructure across the state: Encouraging more charging infrastructure for medium- and heavy-duty vehicles across the state through LCFS credit opportunities.

The LCFS’s original goal was to reach a 20% reduction in carbon emissions by 2030. However, these amendments would push California to carbon neutrality by 2045 by strengthening restrictions on fossil fuels.

Key Impacts to Fleet Owners

The proposed changes would result in key impacts on EV fleet owners. One of the most significant amendments is the extension of the program to 2045, allowing an additional 15 years of credit generation to fleet owners. In addition, the amendments include altering forklift credit generation, increasing the value of LCFS credits, and improving the affordability and accessibility of EVs.

Modified Credit Generation for Electric Forklifts

As a result of these amendments, low-carbon small forklifts will no longer be able to earn credits at the same rate as fully electric forklifts. The new amendments to the LCFS will lead to more stringent restrictions on fossil fuels. This would include a reduction in the ability of low carbon and alternate fuels that are not fully zero-emission to earn credits. Eventually, small forklifts that are not fully zero-emission may not be eligible to earn credits at all.

Large forklifts (>12,000 lb carrying capacity) will not be impacted by this amendment, as many large forklifts do not yet have the capability of being fully electric.

Learn more about the process of credit generation under the LCFS: How Do LCFS Credits Work? Breaking Down the Low Carbon Fuel Standard Credit System

Improved Credit Generation for EV Fleet Owners

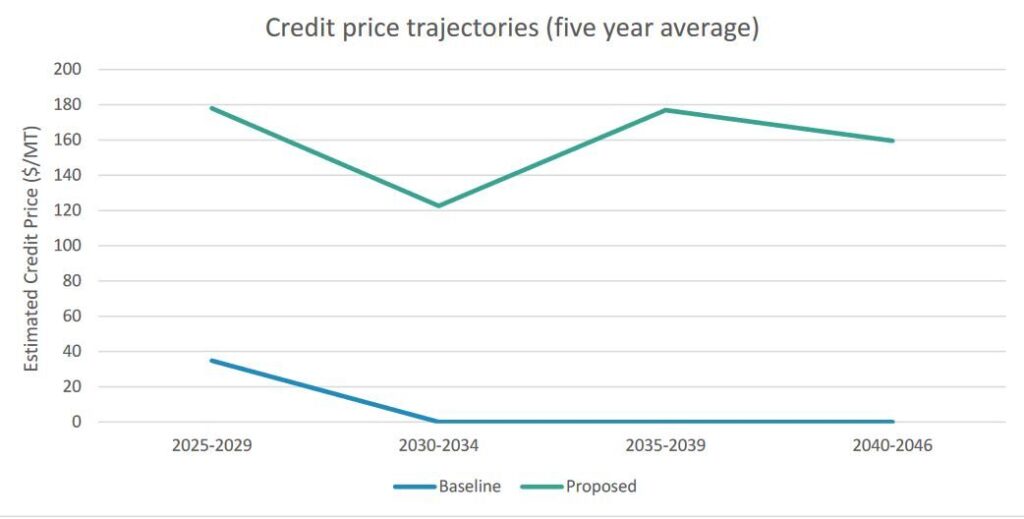

The proposed amendments aim to increase the value of LCFS credits, offering fleet owners steady earning potential. This will be made possible through an automatic acceleration mechanism (AAM) that adjusts the credit market to keep the value of LCFS credits high. Currently, credit generators are reducing their carbon emissions faster than fuel suppliers, leading to an overproduction of LCFS credits. This surplus of LCFS credits leads to a dip in credit value due to supply outweighing demand. However, when California meets its emission reduction targets ahead of schedule, the AAM will automatically set a new, more stringent CI target, making the requirements for lowering carbon emissions stricter. This ensures that fuel producers must continue to either reduce the carbon intensity of their fuel product lines or buy credits to offset their deficits.

For example, the current goal of the LCFS is to reduce the CI of the fuel pool by 15% by 2026 and 16.25% by 2027. However, if California reaches a CI reduction of 20% by 2026, the AAM could accelerate the decarbonization goals and require a 21.25% reduction in 2027, rather than 16.25%. This will stabilize the supply and demand of the LCFS credit market, keeping credit values consistently high.

Under the proposed amendments, the value of LCFS credits is expected to increase by almost 500%.

Improving the Availability and Affordability of Electric Vehicles

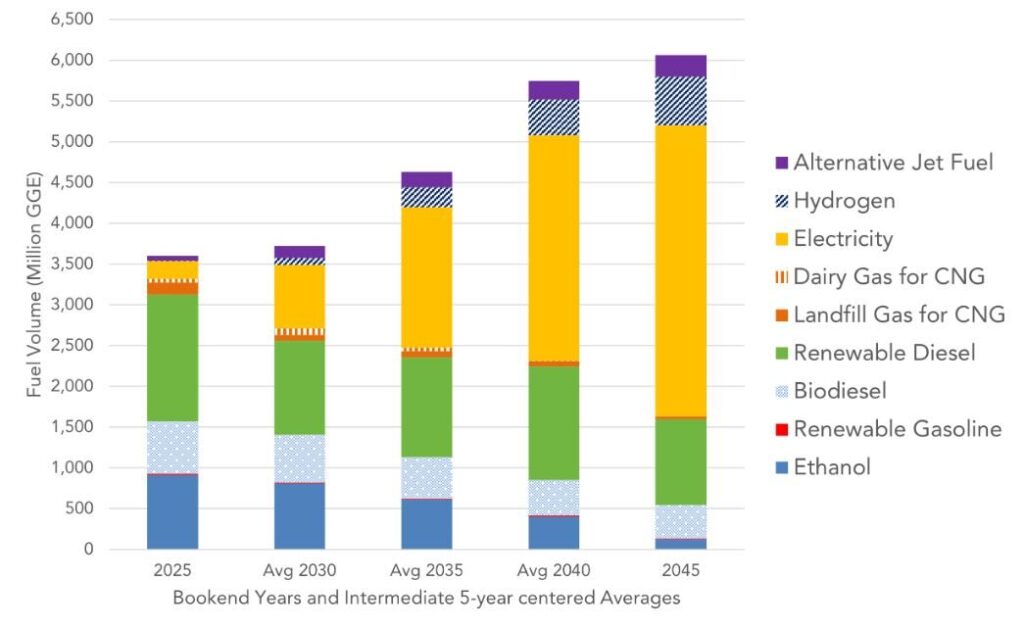

The amendments will bolster the usage of electric and hydrogen vehicles across the state. This is projected to lower the upfront costs of electric vehicles by a significant margin. Alternative fuels like renewable diesel and biodiesel have previously been eligible for credit generation. However, stricter CI goals will target low-carbon and alternative fuels to push them to zero-emission status or phase them out of the fuel pool. This will result in lower credit generation for alternative fuels and further incentivize the deployment of zero-emission fuels and vehicles. As EVs begin to make up a greater portion of the fuel pool, the upfront cost of EVs will likely decrease.

CARB proposes the increased stringency of fossil fuels, leading to a drastic increase in the deployment of electric and hydrogen fuels.

Fleet owners can optimize their credit generation potential ahead of these amendments by partnering with Smart Charging Technologies (SCT). SCT helps fleet owners take advantage of LCFS incentives and allows you to sell your credits in bulk for the highest price. Learn more about partnering with SCT and maximizing your earnings through the LCFS: California's LCFS Program.

Improved Zero Emission Vehicle Charging Infrastructure

To keep up with the increasing number of ZEVs on the road, CARB will increase investments in fast-charging stations and hydrogen fueling infrastructure across the state. Currently, organizations are eligible to earn credits for light-duty vehicle fueling infrastructure projects. The amendments would expand credit generation eligibility to medium- and heavy-duty (MHD) sectors, specifically in rural and low-income areas. This will significantly improve charging infrastructure for electric trucks across California.

In addition, CARB is proposing provisions specifically for projects that install fast-charging and hydrogen fueling stations in freight corridors. This focuses on improving access to charging stations for commercial trucks, which have previously been limited by a lack of charging infrastructure across the state.

By increasing the stringency of CI targets and expanding infrastructure support, these amendments aim to foster greater access to ZEVs across California. While the amendments are not yet finalized, CARB is rapidly moving forward with updates to the LCFS. A public hearing to discuss these changes is scheduled for November 2024, and if approved, changes will go into effect in early 2025. Stay up-to-date with regulatory changes to the LCFS and check back for updates as these amendments progress.

Related Posts